The global demand for proteins is not only a question of filling basic physiological needs. The market for functional foods that are rich in protein—targeting sports performance, weight management, and healthy aging—is expanding quickly, driven by growing consumer awareness around health and nutrition at every stage of life. Furthermore, the recent popularity of GLP-1 treatments for weight loss has emerged as a new factor boosting the demand for high-protein foods and supplements.

Director of Ingredients

Gira

Consultant

Gira

According to the projections of the United Nations, the global population will grow by 1.5 billion people by 2050. This booming population is a real challenge for the agricultural and food industries as it requires producing enough food that meets proper nutritional standards, is sustainable, and affordable for all. The following article provides insights into the future of the protein market, based on recent research and forecasts from Gira—an established market leader in the food and feed sectors. With strong connections to key industry players and opinion leaders, Gira provides high-quality analyses that help businesses navigate global trends and future opportunities in protein ingredients.

RISING CHALLENGES FOR CONVENTIONAL PROTEINS

Gira estimates that “conventional” proteins—those derived from dairy, meat, and eggs—currently account for 57% of global protein needs. However, the distribution of these proteins is uneven. North America and Europe have more than enough to meet their nutritional requirements, while regions like India, Africa, and parts of Asia, to a lesser extent, are already relying more on plant-based proteins and other alternatives.

In 2050, Gira estimates that the global protein requirements will be 37 mio tons, i.e. an additional volume of 23 mio tons compared to 2024, which cannot be fully met by conventional ingredients. Indeed, the global dairy and meat sectors face increasing production challenges, from sustainability pressure to lifting production costs, international trade issues, disease outbreaks, etc.

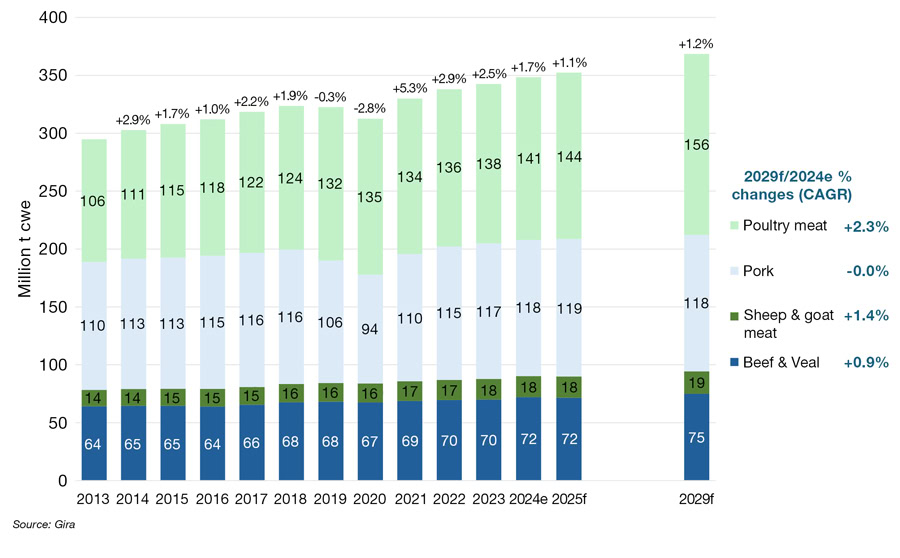

In 2024, meat production (chicken, pork, beef, and sheep) exceeded 350 million tonnes in carcass weight equivalent. Gira forecasts a continuous growth, around 1.2% annually through 2029, with numerous uncertainties linked to unstable politics and economics, impact of inflation over consumer demand and ongoing animal health crises. In any case, this expected growth represents an additional volume of only 3-4 mio tons of proteins over the 23 mio needed!

As far as the dairy sector is concerned, milk supply reached more than 610 billion liters in 2024 and should lift by 1.6% per year by 2029. In some region, in Europe particularly, milk supply growth is expected to remain limited due to strict environmental measures and low attractivity of dairy farming in some European countries. Globally, by 2050, we estimate that the dairy sector will be able to bring 2.4 mio tons more of protein in the market, thus still far less than 23 mio tons required…

NOT ONLY A QUESTION OF QUANTITY

The global demand for proteins is not only a question of filling basic physiological needs. The market for functional foods that are rich in protein—targeting sports performance, weight management, and healthy aging—is expanding quickly, driven by growing consumer awareness around health and nutrition at every stage of life. Furthermore, the recent popularity of GLP-1 treatments for weight loss has emerged as a new factor boosting the demand for high-protein foods and supplements.

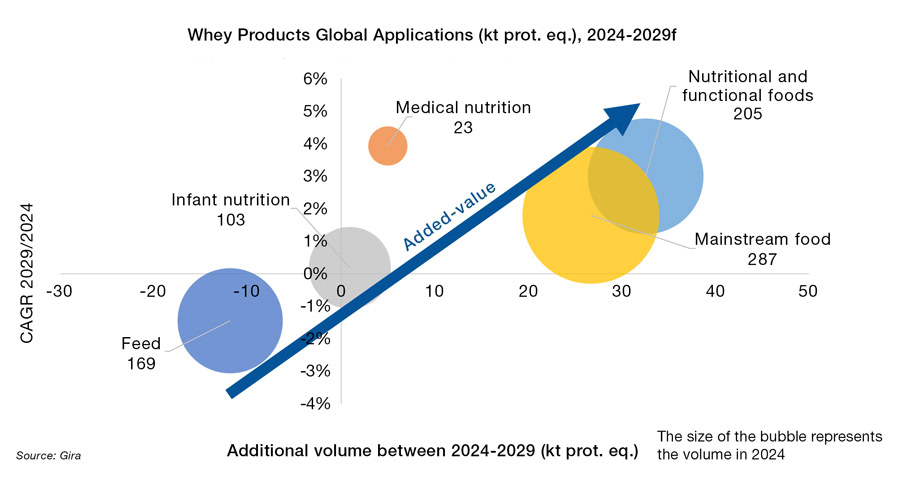

Dairy processors have taken full advantage of this trend with the development of high added-value proteins like whey and milk protein concentrates and isolates, increasingly used in nutritional and functional foods such as high-protein supplements, beverages and bars. This phenomenon happens to the detriment of dairy commodities like milk powders used in less sophisticated sectors such as mainstream food and animal feed.

WHAT OPPORTUNITIES FOR NON-ANIMAL SOURCES OF PROTEINS?

Alternative proteins, such as plant proteins, insects, mycoproteins, ingredients derived from biotechnologies (precision fermentation, cell cultured) are providing interesting solutions, despite many constraints (from regulation approval to raising capital, scale up capacities, high production costs, consumer acceptance, etc.).

Plant proteins are gaining traction thanks to ongoing innovation across the entire value chain—from field to fork. While soy and wheat currently dominate the global market, a diverse range of alternative sources is also being actively developed. For instance, pea proteins (whether under concentrate, isolate or TVP-form) gained momentum in the past few years thanks to their characteristics: Allergen-free, non-GMO, high nutritional content, environmental-friendliness, etc. Pea protein production grew within multiple end-user sectors, and especially meat alternatives. However, after a fast development during the past decade, post-Covid sales of plant-based alternatives to meat are experiencing limited growth uptake and even decline in some regions as lots of consumers have been unsatisfied by organoleptic qualities of the products.

On top of this, other challenges like the competition between plant protein sources (between pea and fava bean for instance) and the variability of yield due to climate change force the plant proteins industry to re-structure. Plant protein producing companies are thus investing into novel technologies improving nutritional content, functionalities, taste and texture (to clear off-notes and create textures that are close to conventional meat) in order to meet industry and consumers expectations. Looking for high added value applications like sport and active nutrition is also part of the new strategies.

Bioengineered proteins like proteins produced by precision fermentation are not yet at scale for various reasons: lack of capital, lack of available bioreactors or complicated regulation approval. To date, these ingredients are often non-competitive in terms of price compared to conventional proteins. Consequently, most start-ups are turning to high added-value ingredients meeting broader functionalities than their animal counterparts. Properties like gelling, foaming, and high solubility at low inclusion rates are looked after by industrials and could be met by these bioengineered ingredients.

![]() WHAT’S NEXT FOR PROTEINS? ANIMAL, PLANT-BASED, OR HYBRID SOLUTIONS?

WHAT’S NEXT FOR PROTEINS? ANIMAL, PLANT-BASED, OR HYBRID SOLUTIONS?

Hybrid food products, blending animal proteins with plant-based alternatives, are experiencing a resurgence driven by sustainability goals. Originating from cost and functionality needs these products now aim to reduce meat and dairy consumption while still satisfying consumer preferences. However, confusing marketing and limited consumer awareness hinder adoption for the moment. Despite these hurdles, the potential for hybrid products to improve sustainability and nutrition remains significant. Strategic approaches to pricing, taste, and marketing will be crucial for their success in the mass market.

WHO IS GIRA?

Gira is a strategic consultancy and market research firm founded 50 years ago. We operate in the food and drink sectors and the food-based retail chain throughout the whole of Europe and worldwide in some product sectors such as meat, fish, dairy and ingredients. We cover all aspects – not just agricultural production, processing, wholesale and retail, but also packaging, machinery & equipment, services, foodservice etc., and consumer research. Our longevity is due to our 100% commitment to our core area of expertise – the food chain and its environment. If you’re a manufacturer or a retailer, a cooperative or a trader, an investor or a packaging or machinery supplier, Gira knows your business and that of your clients.

Gira is continuously keeping its client up-to-date with the latest market updates. We are currently releasing a study on the pea protein market in Europe, together with the impact of GLP-1 on global protein production, dairy and meat market updates, etc.

About Mylène Potier

Mylène Potier brings specialist nutrition expertise to Gira. With a PhD in human nutrition, Mylène Potier is responsible for the technical ingredient aspects of Gira’s work with the food industry; she is currently developing Gira’s forefront expertise.About Laurène Bajard

With a Masters’s in Agribusiness Engineering & Economics, Laurène Bajard has a strong understanding of the industry, from production to marketing. She is specialised in protein alternatives, following latest trends, strategy and innovations.