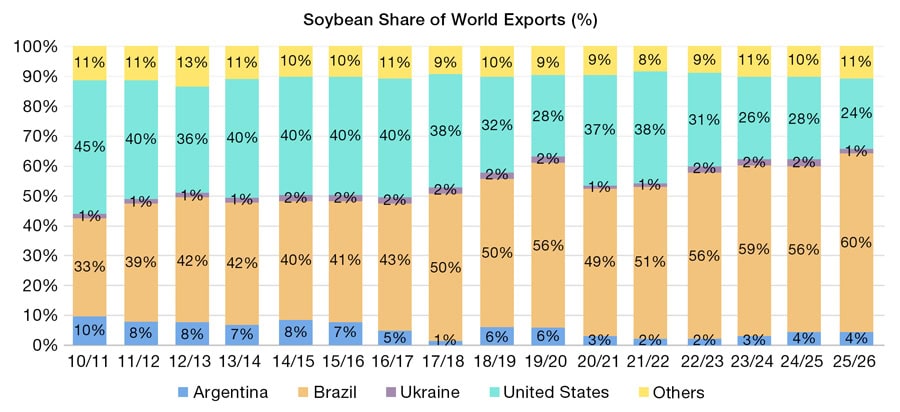

It all comes down to Brazil and Argentina’s 2026 crop. Hedgepoint Market Intelligence analyst team estimates, with normal weather and trend line yields, Brazil may have a record soybean crop of 178 mmt. Should that crop materialize without a negative impact from La Niña, the trend of large global crops keeping prices contained will likely continue in the short term.

Head of US Agriculture

Hedgepoint

Rising uncertainty in global agricultural markets—driven by climate volatility, geopolitical tensions and shifting trade flows—is reshaping cost structures and sourcing strategies across the feed industry. Price fluctuations in corn, soybeans and other key feed ingredients are no longer a temporary disruption but have become a structural challenge, making risk management a necessity rather than a choice for producers. In our interview with Chris Trant, Head of US Agriculture at Hedgepoint, we examine the 2026 projections and the key dynamics expected to shape markets. Trant addresses critical themes ranging from La Niña risks in South America and China’s strategic soybean stock policies to shifting protein demand in the livestock sector and next-generation risk management tools such as “Parametric Derivatives”. For feed industry professionals seeking cost stability and supply security in feed raw materials, this analysis offers valuable insights into navigating an increasingly uncertain year.

Mr. Trant, firstly, could you introduce Hedgepoint to our audience? What do you do, which markets and regions do you specifically focus on?

Hedgepoint is an independent and global Agricultural & Energy risk management firm. Our clients face commodity price volatility as part of their business – our role is to provide clients access to risk management derivatives and tailored strategies to turn risks into opportunities. We have offices across five continents, offering over 450 hedging strategies for more than 60 commodities and currencies.

Speaking from the US Agriculture perspective, our primary clients are those connected with row crop production, commercial processing, and livestock feeding. Our role is to offer a menu of custom strategies to fit the client’s unique profile and needs.

Looking at 2026, how do you assess the overall outlook for global agriculture, particularly in terms of production trends, trade flows and major macroeconomic pressures?

Let’s start with the financial health of the global farmer – where the food supply chain ultimately starts. The farmer is facing a perfect storm of crises – after years of large global crop production, the sale price grains and oilseeds have been pressured. Compounding this revenue problem, the farmer has not been immune to inflation pressure. Costs have gone up: interest rates on loans, seed, chemical inputs, fertilizer, and transportation costs have all increased. The result is margin compression and the potential that the farmer in 2026 may be forced to invest and produce less.

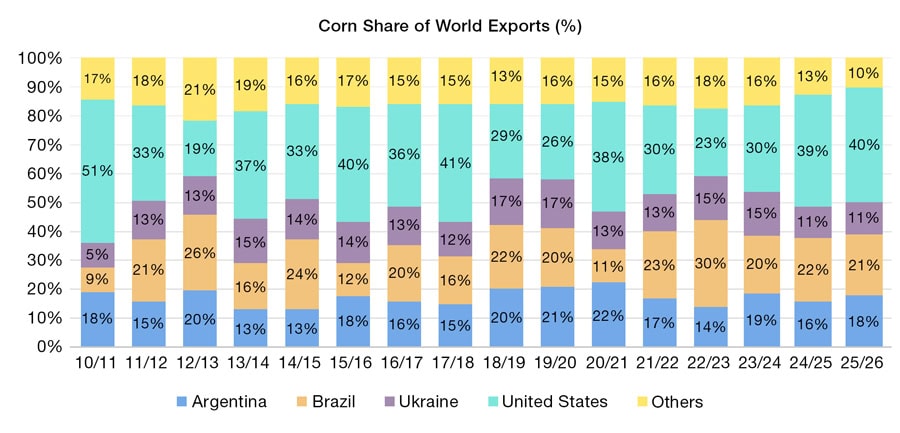

From a global trade flow standpoint, over the past decade, the United States has lost global export market share to South America. With a potential record soybean crop being planted in Brazil and increased US domestic consumption of soybean oil for biodiesel, South America will likely continue to be the critical supply source for global food next year. However, if there is a weather event in South America in 2026, this trend may be upended, as the US will be one of the few sources with ample stocks from 2025.

The United Nations World Food Program projects 318 million people will face acute hunger in 2026- double pre-pandemic levels. This is a manmade famine, not the result of a crop production shortfall, but rather military conflict and associated supply disruptions. Conflicts in Africa, the Black Sea, Red Sea, and Middle East all have served to disrupt the distribution of food.

As you mentioned, weather extremes, logistics disruptions and geopolitical tensions are reshaping commodity markets. How do you expect these factors to influence global grain and oilseed availability in 2026, and which regions do you see as the most vulnerable or resilient?

Climate is becoming increasingly volatile, violent, and unpredictable. Despite that, the world’s recent crop cycles have been rather ample. Arguably, the last major supply disruption was in 2022 during the start of Ukraine War. At some point, perhaps in 2026 or perhaps later, the world will have to contend with a climate driven crop production disruption that we have not seen in recent crop cycles.

The region that has the most concerning potential for a weather driven supply disruption in 2026 is the critical global export countries of Brazil and Argentina. The world is facing its 5th La Niña in six years, which may stress crop development in South America. La Niña results in a dryer and warmer trend in major growing regions of South America. With South American farmers beginning their soybean new crop, the market will watch weather trends and crop development very closely.

![]() Should South America have a weather event that impacts crop production, the likely benefactor would be the United States which has burdensome stocks from 2025’s harvest and the ability to meet dislocated export demand should South America experience a production shortage.

Should South America have a weather event that impacts crop production, the likely benefactor would be the United States which has burdensome stocks from 2025’s harvest and the ability to meet dislocated export demand should South America experience a production shortage.

Feed raw materials like corn, soybean meal, and wheat saw significant price swings in 2024–2025. Based on your modelling and market signals, what are Hedgepoint’s expectations for supply–demand balances, market trends and price movements in key feed ingredients for 2026?

It all comes down to Brazil and Argentina’s 2026 crop. Hedgepoint Market Intelligence analyst team estimates, with normal weather and trend line yields, Brazil may have a record Soybean crop of 178 mmt. Should that crop materialize without a negative impact from La Niña, the trend of large global crops keeping prices contained will likely continue in the short term.

There are several risks to this assumption however:

1. A South American weather event, as previously mentioned

2. US-China trade deal that results in a large increase in China demand for US Agriculture products

3. Government mandated biodiesel programs that result in large increase of US domestic soybean crush

Should just one of those three scenarios occur in 2026, it is possible we will see price volatility increase to the upside. Even more so should a combination of the three occur.

Volatility has become a structural feature rather than a temporary spike. What are the main volatility triggers Hedgepoint is tracking for 2026 in terms of weather models, global stocks, or policy decisions, and how do you suggest feed manufacturers prepare for them?

For weather, La Niña in South America over January and February will be the metric. This time period is the key time for Brazil Soybeans, Argentina Corn and Soybeans, and the start of the Brazil Safrinha crop planting.

Turning to global stocks and trade – it is interesting to note that China has maintained Soybean reserves of around 44mmt the past few years. Historically, China’s ending stocks would fluctuate along with demand and pricing. It now appears that the 44mmt level is a strategic target from the Chinese government. At normal consumption, this represents about three months of normal Chinese crush demand. With a possible US – China Trade Soybean thaw appearing, it will be interesting to see if new US soybean supply is allocated to Chinese Crush demand directly or put directly into the state soybean reserve. Should China buy US Soybeans for stockpiling purposes, this will result in less global soybeans available for global crush.

Another item of note for feed manufacturers in 2026 for those that manufacture soybean meal, will be the livestock herd size in the United States. US Beef prices remain close to all time highs, and the US consumer is responding with a demand shift to more affordable proteins – poultry and pork. If this trend continues in 2026, feed manufacturers may well enjoy strong demand for soybean meal for poultry and pork feeders.

What risk-management strategies or hedging tools do you consider essential for feed and livestock companies? How can they better integrate data, forecasting models and cross-commodity insights to stabilize costs in 2026?

We are seeing a new interest and demand for weather-based risk management tools. Historically, the preferred method to hedge weather risk was in the futures and options market on the underlying commodity price movements. Now, we are seeing specific interest in products that hedge precipitation and climate events! While these products are still rather new, the Chicago Mercantile Exchange offers weather derivatives.

Hedgepoint also offers these tools, also known as Parametric Derivatives. We use public data sources to create a benchmark and track parameters like: Precipitation, Temperature, Wind Speed, Solar Radiation, and Soil Moisture. We then model those parameters to build custom structures based on our client’s regional and operation needs to protect them from extreme weather events.

Besides regular farmers and commodity traders, we see this tool as an alternative for private credit funds, for instance, that have collateral in form of future commodity crops.

I would encourage feed manufacturers to explore these products for their sourcing area regions. If there is a localized flood for example, the broader commodity market may not be as impacted as the feed company who relies on that specific impacted region for their sourcing needs.

About Chris Trant

Chris Trant started his career in the commodity industry as a college intern at Daniels Trading. After graduating from Miami University (OH) with a degree in International Business and History, he worked in various commercial roles with Bunge North America, Green Plains, and Informa / HIS Markit-S&P Global prior to Hedgepoint. Trant lives and works in Chicago and enjoys geopolitical books, cooking Italian food, and running along the lakefront.